[Official Transcript]

Adam: This line represents the $5 mark…

It is a boundary line representing a massive opportunity for investors today … and it’s giving us, a HUGE advantage over Wall Street.

But you won’t find this $5 boundary line listed on your brokers website … you won’t read about it in the Wall Street Journal … and you won’t find it described on a Bloomberg terminal.

Yet, understanding the power of this $5 line can lead you to invest in small, overlooked stocks, with the potential to see an explosion of profits this year.

I’m talking once in a decade opportunities.

Let me explain.

When the stock price of a good company trades ABOVE $5 a share, it gets everyone’s attention.

Analysts will cover the stock on CNBC and in the financial media. And the big institutions spend millions of dollars, adding the stock to their holdings in mass.

But when the stock price of that same company trades BELOW $5 a share…

All the attention disappears.

Simply because the stock price is too small to get any major recognition.

Financial analysts don’t cover the stock anymore…

Big investment advisories like Merrill Lynch ignore these stocks.

And many of the big mutual funds, hedge funds, and pensions, aren’t even allowed to buy a stock below $5. Even IF it’s a solid play.

So essentially, the stock becomes invisible to Wall Street.

It goes unnoticed … undetected … and completely off the radar.

Many times, unjustifiably so.

Above $5 a share, and everyone notices.

Below $5 a share, and the stock is practically invisible.

That’s why the $5 line represents a massive opportunity for main street investors today.

Because when you get into the right, “under the radar” stock … right before it crosses the $5 share price and gets Wall Street’s attention … you have the potential to see some extraordinary gains. Especially in turbulent markets like what we’re seeing today.

For example, following the bottom of the market in 2009, the top 10 performing stocks for the year had an average share price of only $4.50 … Yet, they have gone on to see an average gain of 6,900%.

These winners include major stocks like Amazon, La-Z-Boy and United Rentals. Which all traded below $5 … and have gone on to see some phenomenal returns.

It’s the same thing with the top 10 stocks since the bottom of the dot-com bubble in 2002. The average share price of these top performing stocks was only $3.96. And they’ve gone on to see an average gain of more than 16,500% since then.

Stocks like Apple, NVIDIA, and Steel Dynamics — which as you can see, all traded well below $5 — have gone on to explode, making record breaking profits.

When these stocks traded below $5, nobody wanted to talk about them. Even though they were fantastic opportunities.

But then these stocks SURGED far beyond $5, and went on to make history. With Apple and Amazon becoming the world’s first trillion-dollar companies.

Now, we’re seeing this same scenario play out again in our current market.

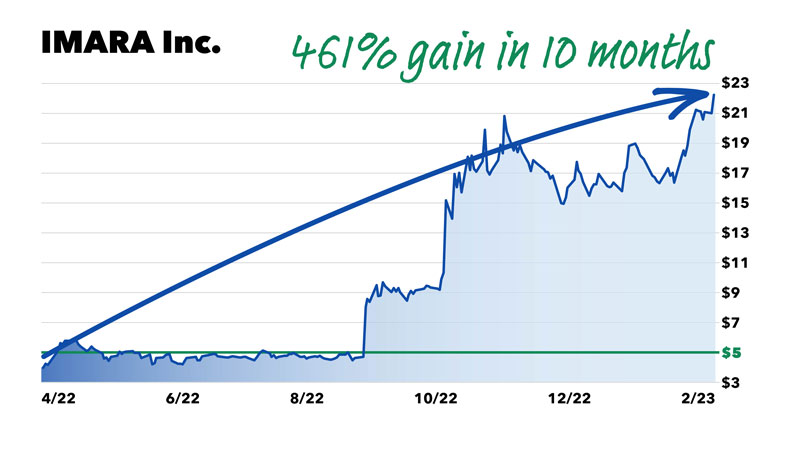

With stocks like IMARA, which traded below $5 for most of last year, only to see a spike. Making an incredible 460% gain in just 10 months…

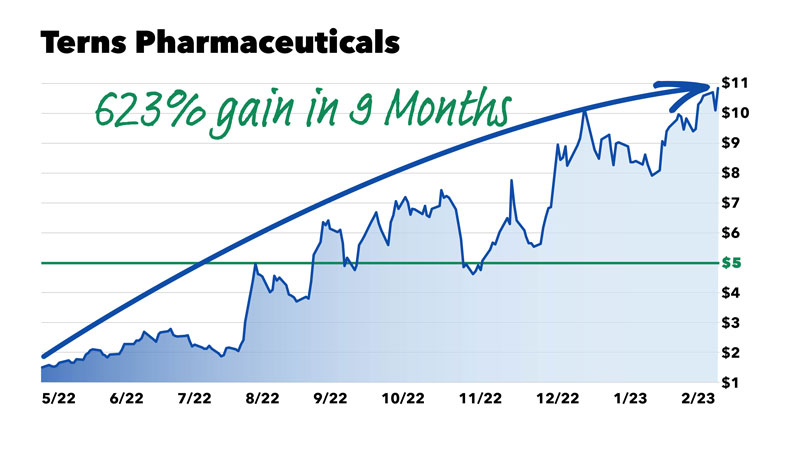

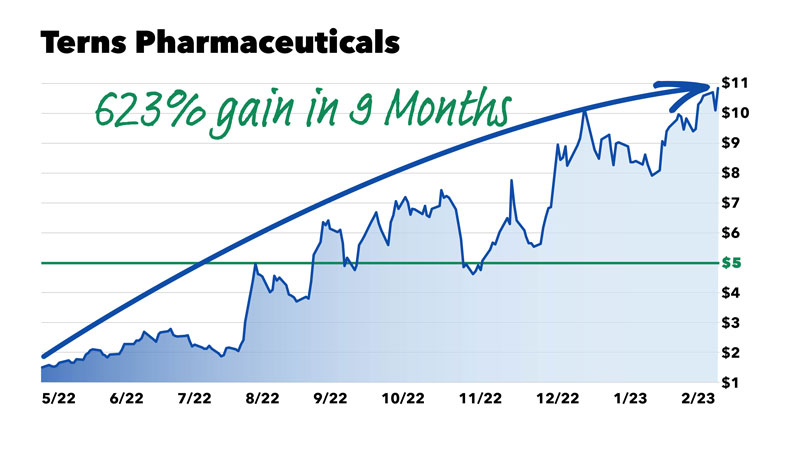

Then there’s Terns Pharmaceuticals, which also traded below $5 for most of last year.

Yet surged, seeing a 620% peak gain in only 9 months…

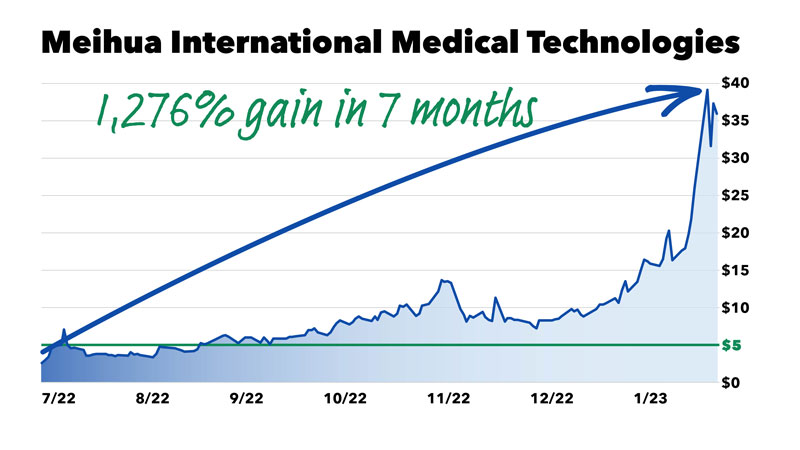

And then there’s Meihua International Medical Technologies. Which again, traded for less than $5 most of last year. And has recently seen an EXPLOSION of profits, gaining more than 1,200% in a mere 7 months.

Each one of these three stocks traded below $5 a share.

They went under Wall Street’s radar.

They were ignored by the analysts.

But then, the share price began to rise exponentially.

Once it crossed $5, the stock immediately caught everyone’s attention.

And with the new momentum, each one of these stocks surged to peaks of more than 5X and even 10X in less than a year.

A $10,000 investment into each of these three stocks, at the perfect time, would have grown to $266,000.

That’s more than a quarter of a million dollars on just THREE stocks…

These are just a few recent market winners I uncovered in my research, to help illustrate how BIG this opportunity is for you.

Now, because of the turbulent market over the last few years … there are more stocks trading below $5 a share than ever before — 1,955 stocks in fact, trading below $5.

That’s 1 out of every 5 publicly listed stocks today…

To be clear, these ARE NOT penny stocks or pink sheets that trade over the counter.

These are small, overlooked stocks that trade on major exchanges like the NASDAQ and New York Stock Exchange.

The best of which have the potential to make some extraordinary gains.

But here’s the thing…

Since many of these small, below $5 stocks are being ignored, and don’t get any major news coverage…

It can be very difficult for everyday investors on main street to sort through them all, looking for the rare opportunities with the greatest potential to become the next Apple or Amazon.

That’s why I’ve spent the last 24 months developing a brand-new strategy using my patent-pending rating system to HUNT for the very best of these high-quality — yet, tiny, “under the radar" stocks while they’re still small … BEFORE they get everyone’s attention and go up.

And to use my new strategy to find the very best stocks below $5 that could soar as high as 500% this year. Stocks like IMARA., Terns Pharmaceuticals, and Meihua International…

The key is eliminating as much risk as possible so you know which stocks to avoid...

And which stocks below $5 are the best to buy.

And then to narrow in on that stock so we buy it at the right time, for the greatest shot at seeing the most profits.

That’s what you’ll discover today.

THIS is our ADVANTAGE.

A chance for you to cash in on this unique, once-in-a-decade opportunity, and get a leg up on Wall Street.

And have the shot at going after record-breaking profits this year.

My name is Adam O’Dell.

Welcome to the $5 Stock Summit.

Amanda: Hello, and thank you for joining us. I’ll be your host for today’s special event. And Adam, thank you doing this Summit.

Adam: Absolutely, Amanda. Glad to be here.

Amanda: Now Adam, this sounds like an incredible opportunity you’ve uncovered…

Because 1 in 5 stocks are being completely ignored by the big firms… and the best of which you say, could go on to see 500% gains this year.

Adam: That’s right. I believe my team and I have uncovered something truly remarkable. In fact, this is the BIGGEST market trend to impact investors today. It’s a MEGA-trend really.

Amanda: And I can tell by the profit potential here that this really is that important…

Adam: It is. That’s why I’ve spent the last TWO YEARS extensively researching, analyzing and developing my new strategy to make sure we have the absolute BEST shot at capitalizing on this $5 megatrend.

Because the timing is perfect for main street investors like us to get into the best of these overlooked stocks RIGHT NOW…

While they are still going virtually unnoticed and undetected…

And BEFORE Wall Street’s piles into these stocks and potentially surge 5X or more in over the next year.

Amanda: Certainly seems that way. And I’m excited to talk about your research and your new strategy for targeting these stocks in a moment … as well as the opportunities you’ve lined up for our viewers at home to take advantage of today.

But I just have to say, I did some research on these $5 stocks going under Wall Street’s radar. And it seems like there’s some kind of SEC law that prohibits the big institutions from buying these small stocks.

Adam: Well not quite, but you’re close.

Amanda: So what’s going on here?

Adam: Well most people probably haven’t heard of this before. But according to a 100-year-old law from Congress, stocks trading for less than $5 per share can be too small for hedge funds and mutual funds to buy. So that’s why they can get ignored by the big institutions.

Amanda: So the big firms are out, but then, this sounds like a way for us to buy stocks Wall Street can’t?

Adam: It is. And the precedent for it goes all the way back to 1934 when Congress first established the SEC. So you had that part right. And to this day, many mutual funds and hedge funds have it written into their charters that they won’t buy a stock below $5 a share.

In fact, a lot of big firms even have automatic sell triggers built into their portfolio management, that force them to sell the stock if it goes below this price.

Amanda: No kidding … but why is that?

Adam: There are a number of reasons. For one, when a big institution owns a stock under $5 … they have to do a bunch of extra reporting and file regulation requirements enforced by the SEC.

Amanda: What do you mean, what type of reporting?

Adam: There’s a laundry list of additional paperwork, rules and processes that these institutions have to follow to even consider buying a stock below $5.

And these rules relate to everything from providing additional information on the volume of shares traded … to the stock’s liquidity … to information on the issuing company, among many, many other factors. That quite frankly, doesn’t make it worth the while for these big institutions.

Amanda: So basically, these small stocks aren’t worth the hassle for a multibillion-dollar hedge fund.

Adam: Exactly. But the great thing is, NONE of these additional processes apply to main street investors like us. Which means the opportunity is wide open for us to take advantage of these stocks, while they’re largely ignored by Wall Street.

Amanda: That’s what I like to hear. Finally, the little guy can get a leg up on the big firms.

Adam: Right. And another reason is that the $5 rule from the SEC means these stocks aren’t legally eligible for margin or shorting. And shorting stocks is a big way hedge funds make their money.

Amanda: So, if the hedge funds can’t use the stock to make money, they don’t have a lot of use for it. But if hedge funds can’t short these stocks, that probably gives them a higher chance of going up, right?

Adam: Exactly. That’s why this is such a valuable market inefficiency — a glitch in the system if you will. But it’s OUR advantage.

For instance, you can have one company that has two hundred million shares trading at $5 a piece … and that’s a billion-dollar company.

Yet another company might only have a million shares, trading at $1,000 a piece. And that’s also a billion-dollar company.

So, the share price isn’t what matters for a stock. All that matters is if the company has strong financials and is a solid running business.

Amanda: Kind of sounds like Wall Street is throwing the baby out with the bathwater then…

Adam: In many cases they are.

Amanda: So now it makes sense why these $5 stocks would essentially drop off the radar. Wall Street considers them small potatoes and it’s a headache for them to own.

Now, does that just apply to bad stocks. Or do they still have to sell a good, quality stocks too?

Adam: In many cases, they have to sell the stock no matter what. It doesn’t matter if the stock has great profits, incredible products, or is on the cusp of a major breakthrough.

If the share price is too low, Wall Street totally ignores it.

Amanda: So the stock becomes too small to matter … almost like it’s out of sight, out of mind.

Adam: But the ridiculous thing is, as soon as the stock rises above $5 a share, it pops up on Wall Streets’ radar, and the big firms are free to jump in and scoop up shares.

Amanda: Wait … So a stock could be trading for say, $6.00 on Monday. Then go down to $4.75 later that week because the company received some bad publicity or something.

And just like that, these mutual funds can be forced to sell it. Regardless if it still has strong fundamentals or not?

Adam: Correct.

Amanda: Then, as soon as the stock rises above $5 again, let’s say a couple weeks later…the mutual funds can jump back in and drive the price up even higher. That just sounds so silly.

Adam: Right — it is silly. That’s why I call this inefficiency a major glitch in the system. Because it only applies to the big institutions.

Amanda: But investors like us, we can buy these small, high-quality stocks and hold them. Potentially for some huge profits like you just showed us.

Adam: That’s right. Assuming it’s a good stock with strong fundamentals, a high-rating and meets the other requirements of my new strategy of course. Because not every stock that’s priced below $5 is worth buying.

Sometimes a stock’s share price is that low for good reason. The company isn’t doing well, or has poor financials. Obviously, I wouldn’t recommend buying those stocks.

Amanda: Sure, of course.

Adam: It reminds me of back in 2002. When stocks like Stein Mart, Six Flags, and American Airlines Group also traded under $5.

But these stocks were in horrible shape. Each one fell more than 90% and has since been delisted.

Or in the case with American Airlines, it was rescued by merging into a new company.

Amanda: So these examples speak to the need to find the RIGHT $5 and below stocks … stocks with the potential to go up — not down.

Adam: Exactly. And we’re seeing that happen even more so now in our current market. Because there have been some truly amazing stocks that have surged beyond $5 this past year.

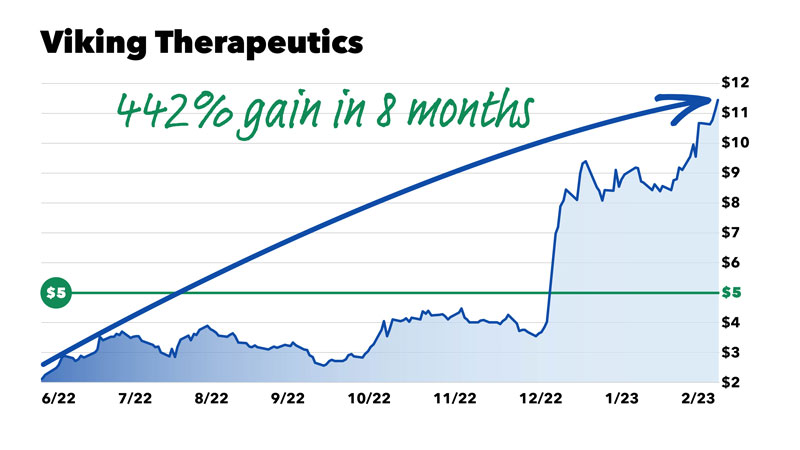

Look at Viking Therapeutics, for example. This stock traded under $5 for most of 2022.

Big institutions like BlackRock, Vanguard and Fidelity abandoned 100% of their positions in the stock.

And the analyst wouldn’t cover it.

For the next several months, Viking Therapeutics was overlooked, ignored and forgotten.

But then, seemingly out of nowhere…

The stock rose above $5, and immediately Wall Street took notice again.

The big institutions jumped right back in, driving the share even price higher.

Analyst started covering the stock…

Brokers began recommending it to their clients…

And within 8 months, Viking Therapeutics went on to soar to a peak gain of 442%.

Amanda: Wow, that’s quite the gain…

Adam: It was an explosion. A profit explosion not many people saw coming.

But for those in the know, all the early indicators were easy to see the whole time.

Yes, Viking Therapeutics traded below $5 for most of last year. But it didn’t vanish. It didn’t go away…

The stock was still there, beginning to make gains.

Yet because of its low share price, it was practically invisible to Wall Street.

Amanda: Well, until it rose above $5 and then the big institutions rushed back in and drove the share price up even higher.

Adam: Exactly. It’s the same story with Terns Pharmaceuticals. I mentioned this stock earlier. Terns also traded below $5 most of last year and was abandoned by Wall Street.

In fact, all three of the largest mutual fund providers in the country — BlackRock, Vanguard and Charles Schwab … closed out of this stock.

It was completely ignored. That is, right until the start of the fourth quarter.

Amanda: What happened then?

Adam: By that point the stock had gained momentum and the share price was rising. It quickly soared past the $5 mark. That’s when the big institutions came flooding back in. And Terns went on to skyrocket to a peak gain of 623% in only 9 months.

Amanda: That’s a pretty hefty gain in just a few months.

Adam: It takes most stocks a decade to see 100%, if they’re lucky. Yet Terns did more than SIX TIMES that in only 9 months.

Amanda: So the point is, bold investors who would have gotten into Terns right when the stock was under Wall Street’s radar, at the perfect time… and sold right at the top, could have seen some amazing gains.

Adam: Terns was an overlooked opportunity that delivered some massive profits.

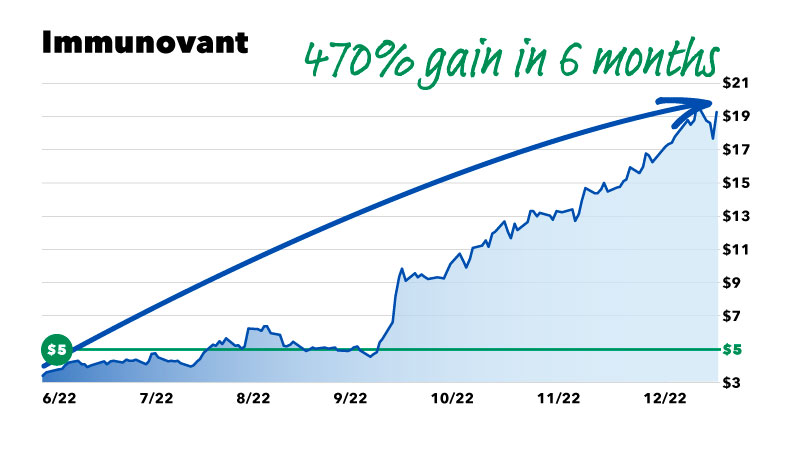

Immunovant is another great market example. This stock also traded below $5 a share during 2022’s bear market. And once again, the big institutions abandoned it.

With firms like Fidelity, Fifth Third, and even the Arizona State Retirement System, closing 100% of their positions.

But Immunovant’s stock quickly rose above $5, and… Amanda?

Amanda: Let me guess, that’s when the big institutions started flooding into the stock and driving the share price up?

Adam: Exactly. Barclays, Prudential Financial, Jane Street and billionaire investor Steve Cohen all jumped in. As well as several other institutions, including the Teacher Retirement System of Texas…

Amanda: Which I’m sure made the stock price surge even higher.

Adam: That’s exactly what happened. And by January of this year, Immunovant was trading for more than $19 a share. Hitting a new, two-year high. And making ambitious investors, who got into Immunovant when it was under $5, a phenomenal peak gain of 470% in just 6 months.

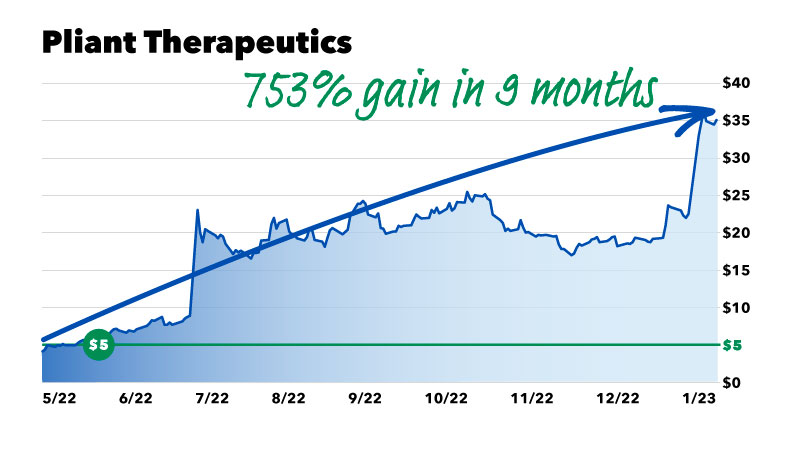

Then there’s Pliant Therapeutics which also traded below $5 last year.

And after being abandoned by institutional investors like BlackRock, Vanguard, Fidelity and Wells Fargo….

The stock went on to gain momentum and immediately rose above the $5 mark.

Amanda: And then they probably went on to see an influx of money from the big institutions, right?

Adam: Right. Money from those same institutions, including BlackRock, all rushed back in and scooped up millions of shares, driving the stock price higher.

Pliant Therapeutics stock went on to surge 753% in just 8 and a half months, trading as much as $34 a share.

Amanda: So another incredible example of a big fund like BlackRock, selling the stock when it drops off their radar… trading below $5 a share … only to buy it back a short time later … and make the stock price surge.

Adam: That’s 100% the case. And as you can see, it has happened over and over and over again.

Amanda: Adam, this is amazing.

Ok, so to quickly summarize for our viewers at home:

When stocks trade under $5, most fund managers follow an outdated rule from the 1930’s that can keep them from buying the stock. And can even make them sell it. The analysts stop covering it … and most people move on.

But for you Adam, this is when the stock gets interesting. Because if these “invisible” stocks score well on your rating system…you can filter out the best ones you believe have the greatest potential to go up using your new strategy.

Adam: That’s right. And like I said, right now there are plenty of, high-quality, highly rated stocks I’ve found with my new strategy that I expect could easily see exponential triple-digit gains this year.

Specifically, I believe my favorite $5 stocks right now will see an gains of 500% or more, over the next 12 months.

Amanda: Really?

Adam: Absolutely. Because my research shows all the major firms on Wall Street, like BlackRock, Vanguard, and Goldman Sachs, could pour millions of dollars more into these stocks as soon next week.

Basically, as soon as these stocks cross the $5 line, which my ratings system and the indicators in my strategy say could happen any day now.

Amanda: WOW. Ok ... And we’re going to cover those stocks soon. And you’re going to tell us all more about your new strategy. So we know how to get into these opportunities you’ve found while there’s still time.

But to be clear, I want to reiterative something you said earlier for our viewers, These ARE NOT super risky penny stocks, speculative pink sheets, or shaky IPOs. These are regular, small cap stocks that are being overlooked on major exchanges like the NASDAQ and NYSE.

Now Adam, we know all investing carries some amount of risk, and with a strategy like this one, I imagine not all of the trades work out to be big winners like the examples we just talked about? Do you ever see any negative trades?”

Adam: There is no such thing as a 100% perfect trading strategy. But with my new strategy we’re looking for BIG winners. Because, the big wins are the key here.

Remember the average price for the top stocks in 2009 and 2002 was below $5.

And the average gain for those top stocks since 2009 is up more than 6,900%

And more than 16,500% since 2002.

Amanda: And I’m sure those massive winners were more than enough to make up for any down trades along the way.

Adam: Exactly. And as we speak, there are plenty of ordinary stocks below $5 with the potential for extraordinary gains.

That’s why this is really such a rare, once in a decade opportunity for us to go after these types of massive winners.

Amanda: And you think the stocks your new strategy identified are set to soar right NOW?

Adam: Absolutely. And I expect the gains will be MONUMENTAL. Which means the bold investors savvy enough to take advantage of these small stocks NOW, will have the greatest chance at seeing the absolutely biggest profits.

Just like any of these exceptional market winners that have risen above $5 and soared over the last year….

Amanda: Adam this is incredible. I didn’t realize there were so many stocks that have done so well in this market.

Adam: Most people don’t. Especially with all the fearmongering in the media. But the fact is, there are ALWAYS exceptional winners in ANY market. You just have to know where to look. And these are some of the very best examples I found in my research.

That’s why I’m so glad we’re doing this Summit today. I want to give our viewers a plan to position themselves to not just survive. But THRIVE in the coming months and years.

Amanda: Well, if anyone would know how to capitalize on the ins and outs of Wall Street’s rarest, little-known and most promising opportunities, it’d be you. You even managed your own hedge fund for a while, right?

Adam: True, I did … But I love the work I’m doing now even more. It brings me great joy sharing incredible, overlooked opportunities like these, to help main street Americans make money even in this turbulent market.

Amanda: Adam, we’ve worked together for a long time. And I know you’re very humble, so you’d never brag about these accomplishments. That’s why I am going to brag about you for 1 minute.

Adam: Oh come on, that’s not necessary.

Amanda: No, it is. Because there may be some of our viewers who aren’t as familiar with your accomplishments.

You’re recognized among the TOP 1% of all financial analysts in the world.

Over your 20-year career trading at the highest levels… You’ve created multiple, market beating strategies. Strategies that do everything from help people score regular opportunities for double- and triple-digit gains in a matter of months… All the way to helping people score a quick double- and triple-digit winner with simple two-day option trades.

More than a half of million people, in 128 different countries, turn to you for your moneymaking insights every day.

This actually includes top investment pros who work at firms like…

- US Bank

- Morgan Stanley

- Merrill Lynch

- Edward Jones

- UBS and

- Raymond James

All these investing and financial experts look to YOU, because they know you can deliver results.

Adam: I like to think so. And it’s a responsibility I don’t take lightly. I mean, growing up in small town in West Virginia, playing baseball in my backyard as a kid … to running my own hedge fund by the time I was 30 … to now serving as the Chief Investment Strategist for Money & Markets. It’s an accomplishment I’m proud of.

And it’s a great honor for me to provide the guidance and wisdom investors need for the best opportunities to make money in ANY market. Especially today with my favorite $5 stocks.

Amanda: Well, I believe you’re going to help us do just that. Because this is amazing … a unique way for us to get a leg up on Wall Street … and get into these tiny, overlooked stocks before they potentially soar higher.

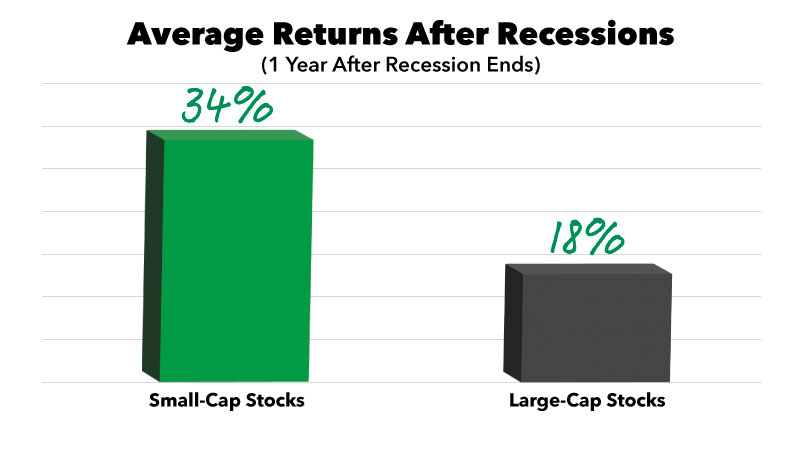

Adam: And again, NOW is the perfect time. Especially when you consider how these small stocks have been proven to outperform the market coming out of an economic downturn.

Nearly doubling the returns of large stocks following 9 of the previous 10 recessions.

Amanda: Wow, nearly double, look at that.

Adam: And as a whole, these small, under the radar stocks have a long history of beating large stocks 6 to 1 for almost a century. Basically since the SEC first established the $5 rule.

Amanda: I’m thinking back to what you said earlier. How the top 10 stocks coming out of both 2009 and 2002 all had an average share price under $5.

Adam: That’s right. And the gains on those top stocks are more than 6,900% since 2009. And more than 16,500% since 2002.

Amanda: So Wall Street ignores these stocks below $5 because they’re so small. And as a result they often go overlooked, unnoticed and undetected.

But investors like us, we can get into the right ones … with the greatest potential of going up.

Adam: That’s precisely what I built my new strategy to help us do.

Amanda: And these extraordinary, historical examples like you’ve shown us today, prove how the best $5 stocks, have gone on to hit a few hundred percent in a few months … all the way up to skyrocketing more than 16,000% ... 30,000% even 60,000% in two decades.

So Adam, now it’s clear why you wanted to put on this special event to show everyone watching at home your new strategy. Because it can give us the shot at making A LOT of money with these small $5 stocks RIGHT NOW.

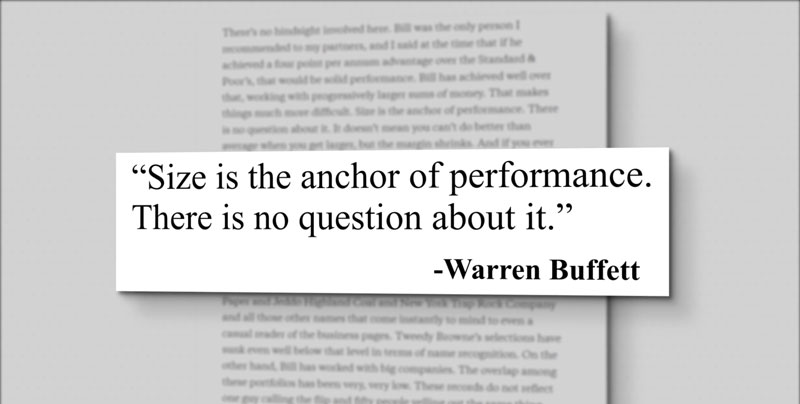

Adam: You know, Warren Buffett would COVET an opportunity like this. But Buffett and the other Wall Street elites CAN’T touch these stocks. Not YET anyway…

Amanda: Because the share prices are so low?

Adam: Exactly. These stocks are totally off their radar. And because of that, they effectively don’t exist for these big firms. But as soon as the stock crosses above the $5 mark… which again, my research shows could happen any day now… the big firms like Buffett’s Berkshire Hathaway and BlackRock are free to jump in and add millions of shares to their holdings.

Amanda: I actually read an article about Buffett talking about this. He said, size is always a problem for him. And that big sums of money were an “anchor”. Meaning he knew there were better opportunities with smaller stocks.

Adam: That’s right.

Amanda: So if a stock rates high on your system and your strategy identifies it as a potential winner, we can buy the stock while it’s still under Wall Street’s radar … way before the big firms get in and drive the share price up.

Adam: That’s the plan. Now of course, nothing is guaranteed. But as my research shows, there is enough market proof of high-quality stocks rising above $5 and going on to see 5X, 10X even 20X over a few months. Again, going all the way back to the turbulent markets of both 2009 and 2002.

So we want to go after the best of these “once in a decade” type opportunities on stocks that have the greatest potential for the biggest returns.

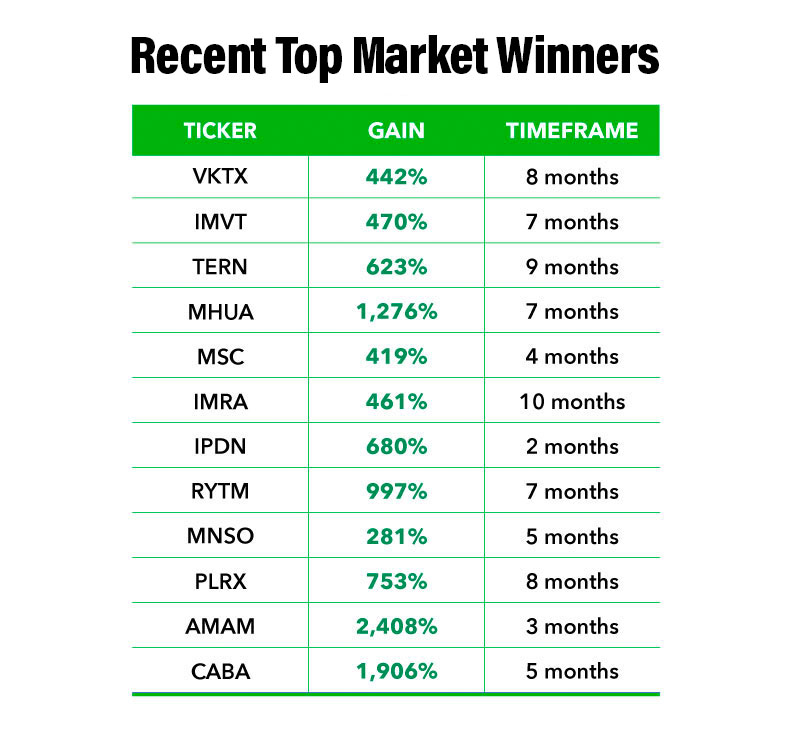

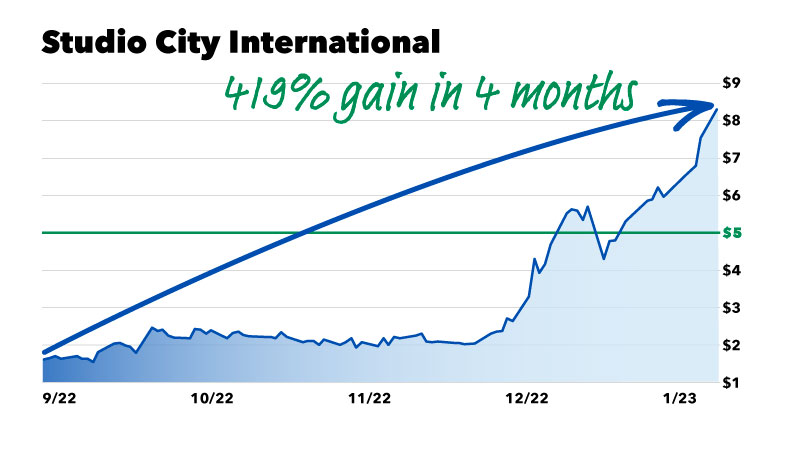

Stocks like Studio City International Holding for example, which saw a 419% gain in 4 months.

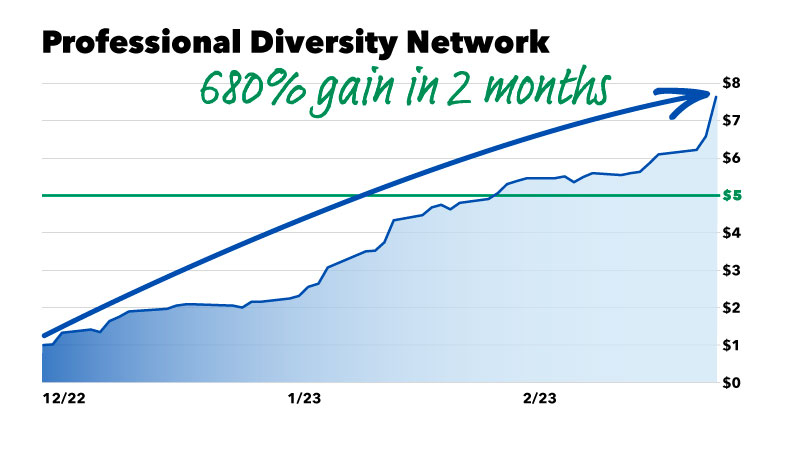

Professional Diversity Network which saw a 680% gain in only 2 months.

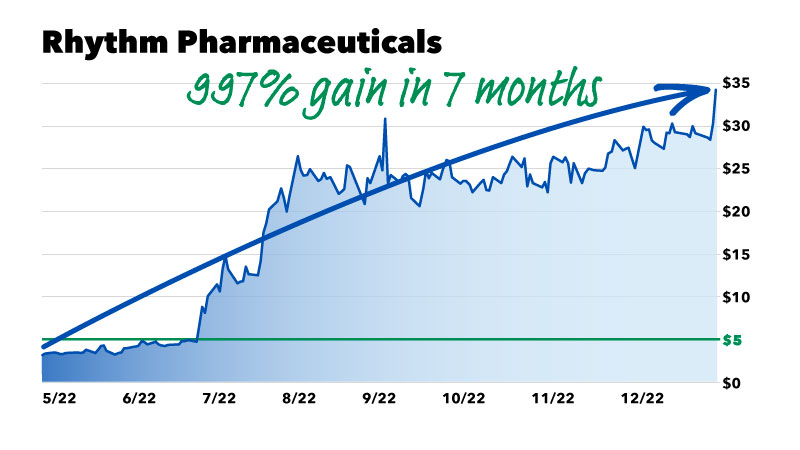

Rhythm Pharmaceuticals which saw 997% gain in 7 months…

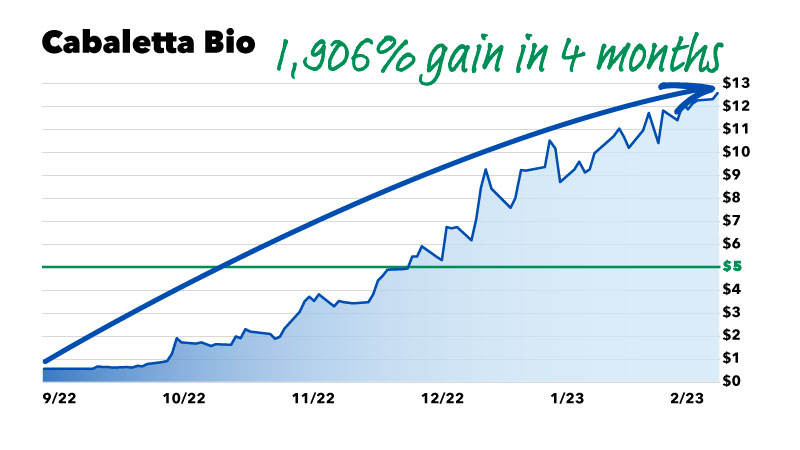

Cabaletta Bio which saw more than a 1,900% gain in only 4 months.

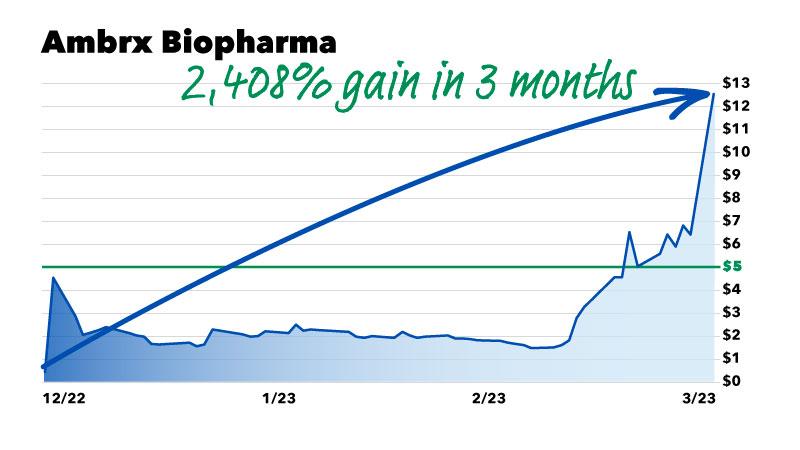

And Ambrx Biopharma which SURGED beyond a 2,400% peak gain in a little under 3 months.

Each of these stocks traded below $5 for most of last year … the big institutions ignored them … abandoned them and forgot about them.

But then the stock picked up momentum and delivered peak gains of 5X, 10X and even 20X in just a few months.

Amanda: This is phenomenal, Adam. And you’re saying right now is the perfect time to use your new strategy because so many stocks are trading below $5?

Adam: Absolutely. Again, there are over 1,900 stocks currently trading below $5. That’s 1 in every 5 stocks going unnoticed and overlooked by Wall Street.

A lot of them are bad and aren’t worth buying. But some — some are truly amazing profit opportunities waiting to take off.

Amanda: And using your new strategy and rating system, you’re on the hunt for these amazing, overlooked stocks. So we can get in BEFORE the big firms really begin to pile into the stock, potentially buying millions of more shares and driving the price up.

Adam: That’s it. You know, when the market is in a period of rapid turbulence like what we’re seeing today, good companies can get swept up in the hysteria of outside forces, and have their stock price pulled down below $5 a share. It’s usually not their fault.

Amanda: So these are forces beyond a single stock’s control. Like what we’ve seen this year with interest rates and everything. Or what you said earlier with the Global Financial Crisis in 2009 and the dot-com bubble in the early 2000’s.

Adam: Correct.

Amanda: And basically, in both of the most recent economic downturns, these $5 stocks have gone on to average way more than 10X returns. This is just incredible.

Adam: Exactly. In fact, in 2009 and 2002 there were nearly 700 stocks that were below $5 that have gone on to see more than a 10X gain.

Amanda: Now you’ve mentioned 2009 and 2002 a few times. And of course that makes sense considering their parallels to our current situation. Do these $5 stock opportunities only appear during bear markets?

Adam: The best $5 stock opportunities tend to come during bear markets. But they happen in bull markets, and even boring flat markets as well.

Amanda: Really?

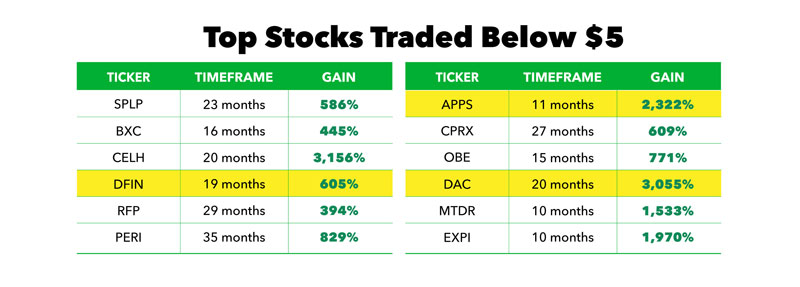

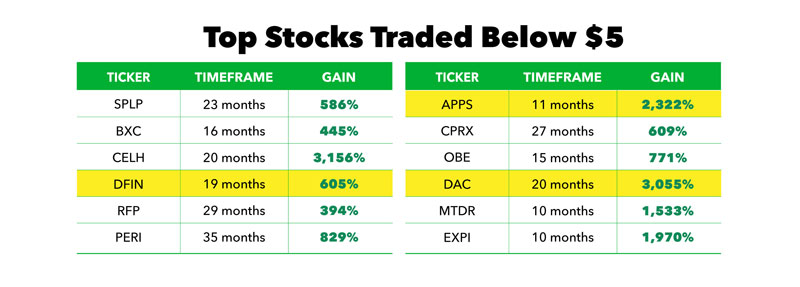

Adam: Here take a look at this. This table is just a snippet of some of the best historical market examples I pulled from my research to illustrate this.

And as you can see, these stocks saw enormous peak gains, during both the bear markets of 2009 and 2002 like we’ve discussed…

As well as the bull market from 2010 to 2020.

All of these stocks, each and every one … traded below $5.

The big intuitional investors ignored them and abandoned them.

Firms like…

- BlackRock

- Vanguard

- Goldman Sachs

- And several major state retirement funds…

All closed out of these stocks.

But then, each stock gained momentum. The share price began to go up.

And finally, the stock delivered exponential profits once it crossed above $5 and the institutional investors rushed back in.

Amanda: And you built your new strategy to go after high quality stocks like these?

Adam: I did. And we’ve codified every piece of it to find the very best stocks priced below $5.

Amanda: Now these stocks are so small they can go up a lot, fast, as we’ve seen here today, but also down a lot, fast.

Adam: That’s right. Which is why, frankly I’ve been working so hard to refine my new strategy over the last two years.

Because the reality is, ALL stocks are risky. And nobody can predict the future.

Sometimes stocks go up, and sometimes stocks go down. And as we’ve seen in our wild market, even supposedly safe, large stocks can stumble.

Amanda: That’s true. There is no such thing as a completely safe stock. For instance, I know the Dow Jones has already dropped nearly 700 points this year.

Adam: That’s my point. But I wanted to eliminate as much of that risk as possible. While also not cutting ourselves off from any opportunities I find that are appropriate.

Amanda: I can understand that. So you’re looking for small overlooked stocks, with the greatest chance of going up.

Adam: Correct. And remember, this is the number one megatrend I’m focused on right now. So, perfecting my strategy has been my number one priority over the last 24 months.

And I’ll just go ahead and mention it, that finding the right megatrend is the first step in my strategy. Because when you find the right megatrend, making mega profits becomes very easy.

Amanda: Well you’ve shown us that today. The gains on these $5 stocks have been extraordinary.

Adam: Well, here’s another example:

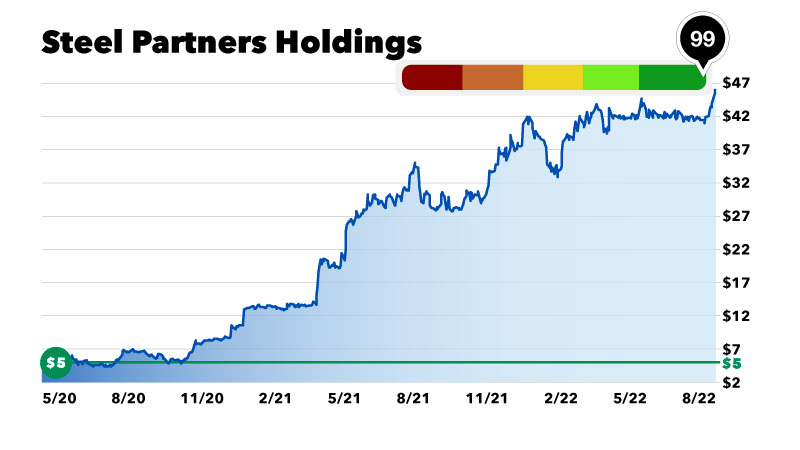

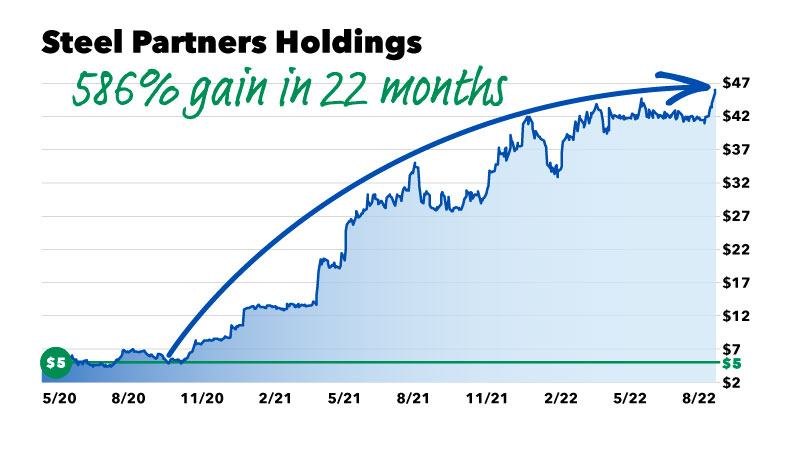

Steel Partner Holdings is a massive conglomerate, with a number of construction, manufacturing, and industrial companies in its portfolio.

But like so many other construction and material companies at the start of the 2020, Steel Partner Holdings traded below $5.

Amanda: That’s when the big firms abandoned the stock?

Adam: Bank of America, Jim Simons’ Renaissance Technologies, and Citadel were among the many big institutions to close out of Steel Partner Holdings during this time.

But soon the stock gained momentum. The share price began to catch up with the stock’s true value.

And as you can see, my system showed the stock had a high rating. Which is my signal to look into it further.

And when Steel Partners Holding crossed the $5 share price and… Amanda?

Amanda: The big institutions started flooding in.

Adam: Goldman Sachs, Citigroup, UBS Barclays, JPMorgan and Wells Fargo all rushed in to scoop up shares of the stock.

Amanda: Which just continued to drive the price even higher.

Adam: Sure enough, Steel Partners SURGED to an all-time high. Reaching a peak gain of 580% in just 22 months. And trading for more than $44 a share.

Amanda: Look at that spike as soon as the stock crossed the $5 line … So basically, this example shows us why it’s SO IMPORTANT to buy at the perfect time. Because getting in too late means you would have missed out on some exponential gains once the big institutions rushed in.

Adam: Exactly. And that’s the second step in my strategy. Buy the right stock at the right time. Right before my indicators say it will likely surge. Because we don’t want to be waiting around for weeks or months on end. We want to get into the stock as close to the perfect time as possible

Amanda: Right when it’s still under the radar and has the greatest potential to see an explosion of profits.

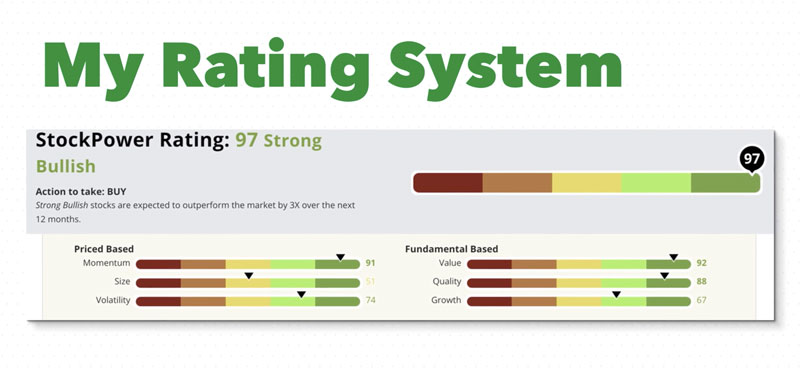

Adam: That’s it. And this is really where my ratings system comes into play. Now, I can’t reveal every piece of criteria my system uses to spot the best opportunities because it would take too much time. And it’s very complex...

But I will say my patent-pending rating system is an AI-based software, that ranks stocks on the six factors that drive market-beating returns.

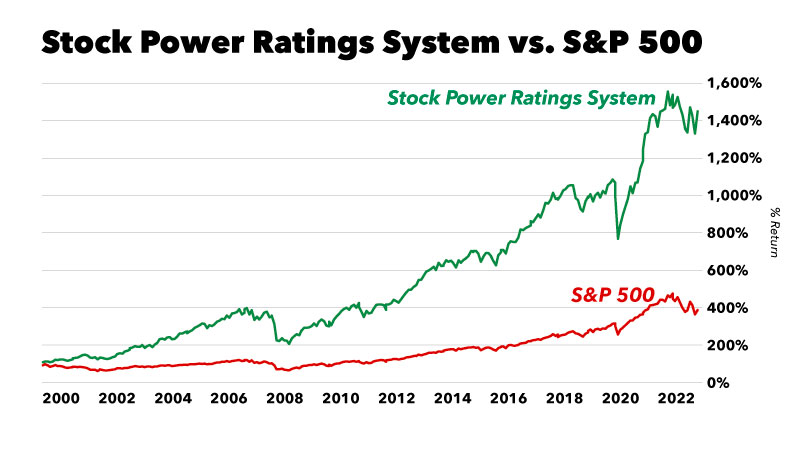

In fact, bullish stocks rated 80 and above on my system, have been proven to beat the market, 3 to 1 over the last 20 years!

Amanda: I know how powerful your stock rating system is. So, it would make sense it’s one of the tools you use to find these incredible profit opportunities.

Adam: It’s the perfect way for me to quickly separate the wheat from the chaff, and narrow down the best opportunities to go deeper with my strategy.

Amanda: Makes total sense.

Adam: Now here’s another example. BlueLinx Holdings. This stock also traded below $5 in the early days of 2020.

Goldman Sachs, UBS, and Jane Street among other big institutions closed 100% of their positions during this time.

But again, my rating system showed that BlueLinx had a high rating.

Soon, the stock rose above $5. That’s when big firms like Vanguard, Ameriprise and Rockefeller Capital Management, all began piling back in.

And BlueLinx went on to skyrocket … seeing a 445% gain in just 15 months, reaching a new high it hadn’t seen in more than a decade and trading for more than $90.

Amanda: WOW … again, just look at that spike after the stock crossed the $5 line … that’s when all the big hedge funds and mutual funds rushed in.

Adam: Here’s another one. Celsius is a developer of flavored sparkling water. This stock traded below $5 in March of 2020. The big institutions sold.

But then the stock started to gain momentum. It rated high on my system.

After rising above $5, the big firms came flooding in. Vanguard, Tower Research, Wells Fargo and the Florida State Board of Retirement System all bought up the stock.

Leading to an extraordinary gain of more than 3,100% in just nineteen months. Celsius went on to trade for more than $100 a share.

Amanda: Incredible. Now I know why you said you spent so much time developing and refining your new strategy: to minimize as much risk as possible, while going after the top stocks with the biggest potential.

Adam: All of these top stocks once traded below $5…

They went under Wall Street’s radar.

But then the stock started to gain momentum. And went on to see exponential gains.

As you can see, that’s a 605% gain on Donnelley Financial Solutions in 19 months…

A 2,322% gain on Digital Turbine in 11 months…

And a 3,055% gain on Danaos Corporation in 20 months.

My research shows my new strategy could have identified all these amazing opportunities on stocks trading below $5 … BEFORE they shot up to these extraordinary gains.

Amanda: So we’re looking at peak gains, higher than 3,000% in less than TWO YEARS…

That’s enough to turn a $10,000 investment into more than $300,000

Adam: Incredible, isn’t it…

Amanda: Now Adam, I bet there are a lot of stocks right now that are trading below $5 ... that have been overlooked by Wall Street, and are ready to go up.

Adam: There are. In fact, my system just alerted me to FIVE stocks that according to my analysis could surge any day now.

Each one of these stocks are already gaining momentum ... and will likely rise above $5 any day now.

Amanda: Well that’s exciting and once they cross $5, you think the big intuitions will pour in?

Adam: Absolutely. My research shows all the major firms on Wall Street — like BlackRock, Vanguard, Goldman Sachs, Charles Schwab and Berkshire Hathaway — all of the institutions we’ve talked about today, could dump millions of dollars more into these stocks as soon next week.

Which, along with my ratings and analysis on these stocks, shows each of these 5 stocks could surge as high as 500% or more this year. And again, RIGHT NOW is the perfect time to act.

Amanda: Because we want to get in BEFORE the institutional money really pours in and drives the share price higher.

Adam: That’s right. Because that’s when we have the best chance of seeing the biggest profits.

Amanda: Just like what happened with all the recent stocks you shared with us today. All winners you found through your extensive research. Each one went on to see peaks of 5X, 10X, 20X and even more than 30X in just a few months’ time.

Adam: And I believe my favorite $5 stocks right now could far exceed even these exceptional gains.

Amanda: Well Adam, I’m in. I’m totally in. Why don’t you tell our viewers how they can get more information on your favorite $5 stocks?

Adam: Sure. I’ve put everything you need to know in a brand-new fast action report called, The Exponential Profits Portfolio: 5 Stocks Set to Surge 500% This Year.

In this special report, I outline everything you need to capitalize on these stocks today. Including…

- The name of the stock and it’s ticker symbol.

- What buy price I recommend.

- And other company specifics vital to your success.

And I can’t stress enough why I’m calling this a “fast action report.” Because all of the indicators in my system are screaming these stocks are about to surge higher.

This is OUR ADVANTAGE. We have a leg up on Wall Street. We have the chance to ACT NOW for the shot at seeing some extraordinary gains.

Amanda: I saw a copy of this report earlier and one thing that is great about it is that its super easy to read. Its not complicated. And of course it’s exciting that these 5 stocks could skyrocket very soon.

Adam: Now, I can’t give you the exact day or hour. But if these 5 stocks do what I expect, waiting just a couple days could be too late. It could be the difference between cashing in a potential 5X gain this year … and making a simple double- or triple-digit win at the tail end of an incredible play.

Amanda: I believe it. You’ve shown us just how fast these stocks can take off once they rise above $5 and the big institutions rush in.

Adam: That’s why you’ll want to act on these stocks right NOW. Before it’s too late and the best profits fly off the table.

Amanda: I must say, you did give us all a sense of urgency when you called for this summit.

Adam: Normally I only find 1, maybe 2 high-quality stocks per month with my strategy. But right now, Amanda, I’m looking at FIVE. So I want to get this report into our viewers hands as FAST as possible.

Amanda: Ok, great. So in this special report, you clearly outline…

- 5 highly rated stocks…

- Quickly approaching $5…

- That you expect will hit 500% this year.

Do I have that right?

Adam: Absolutely.

Amanda: Plus you’re giving us your complete analysis on these stocks to go along with your profit projections.

Adam: Correct. Which means if you get in now, there’s plenty of time to reap all the massive rewards I’m expecting over the next year.

Amanda: Well again Adam, I’m in. And I’m sure our viewers are as well. But this is just the beginning of the opportunities you have in mind for our viewers today.

Adam: That’s right. I’m on a mission to help you succeed and prosper…

And I want to do that by sharing every other exponential profit opportunity I find…

Opportunities that I believe could give you a shot at 5X, or 10X the gains in just a year.

That’s why I want to give our viewers regular opportunities like these, not just today. BUT 12 times a year.

Amanda: So, to be clear, every month for the next year, our viewers will get a new stock pick, that could go up 500%, to 1,000% — or who knows, maybe even as much as 3,000% , like you’ve shown us today?

Adam: I would love nothing more than that. Because like I said, I’m on a MISSION to help you make the biggest gains possible and help you see an explosion of profits.

I want to help YOU build your own fortune now, and well into the future.

That’s why after spending the last 24 months developing this new strategy with my team, and spending more than a million dollars on its development…

I’ve finally opened the doors to my newest stock-picking research service, 10X Stocks.

This service will become my legacy … and I believe it’s the key to seeing incredible gains right now. This is the only place I’ll share my elite, profit producing research on stocks that I believe can make the biggest gains possible.

Amanda: And this is an elite, VIP service.

Adam: It is. And I only want the most ambitious, profit seeking readers to be a part of it.

This service is not for everyone. I designed 10X Stocks specifically for people willing to take a shot on the best of these $5 stocks, and other megatrend opportunities I find, for the chance at seeing some truly incredible 10X gains.

Amanda: So for our viewers at home, can you explain how this works?

Adam: Each month, my team and I will scan the universe of stocks filtering out everything except for only the best opportunities my 10X Stocks strategy identifies in the biggest megatrends.

Amanda: So, things like the energy boom, the rise of artificial intelligence, biotech, and the blockchain.

Adam: Absolutely. And of course, the massive profit opportunities with my favorite $5 stocks today.

And this is the foundation. Because again, when you invest in a megatrend, making mega profits can be very easy.

Amanda: Ok. Makes sense. But how do you find a trend before it becomes a megatrend?

Adam: Great question. So, my team and I have a ton of scanners set up to see where the money is going. If billions of dollars are pouring into energy … then that’s where we want to be.

If billions of dollars are pouring into energy or AI or biotech, that’s where we want to be.

I’m always monitoring where the smart money on Wall Street is moving … whether it’s closing out of a stock or flooding into a stock about to surge.

Amanda: Now, most people don’t have easy access to this kind of intel. But you and your team … you do.

Adam: That’s right. We spend a lot of money … and I mean a lot of money … for this information. But it’s worth it. If we know where the money is going, we can get there first.

Just like I showed you today with stocks when they cross the $5 share price and pop up on Wall Street’s radar.

Amanda: Okay, so the first step is you find the mega trend. What’s next?

Adam: The next step, like I said earlier, is finding the top stock to buy in that megatrend. Now, a LOT of research goes into this…

My team and I … we pull our sleeves back and really dig into the data.

We begin by looking at the size of the company … because the company has to be $5 billion or smaller.

Amanda: $5 billion. That sounds quite large…

Adam: It’s actually not. The typical size of a large cap stock is about $76 billion. So, we’re looking at smaller companies that have a ton of upside potential.

For instance, all the stocks we’ve talked about today had small market caps and traded below $5 before they took off.

Plus, the analysts don’t usually cover these small stocks.

Amanda: And on top of that, like you said, many mutual funds can’t even invest in these stocks because they’re so small. So, this is a pretty unique advantage for us.

Basically you want to get into all these small cap stocks BEFORE they shoot higher so your members can reap the rewards.

Adam: That’s it. And when we look at a stock, we look at everything … the size, megatrend and rating. And we scrutinize the financials. Looking at things like, is the company’s sales rising year over year?

Amanda: And a good profit, right?

Adam: You know, profit isn’t always the most important thing at first. Because it can take years for a newer company to be profitable. But I do want to see that the company is losing less and less money over time and will turn a profit soon.

Amanda: So, it’s at least trending in the right direction.

Adam: Exactly. And we have a ton of metrics for tracking that. All these things matter.

We even look at the product line … do they have a competitive edge? Is there an X-Factor that makes it better than the other companies around it?

Amanda: Well I know from working with you – this takes a lot of research.

Adam: It does. And often times it requires buying the product and trying it out, or even visiting the company in person and checking out their operations. But it still doesn’t stop there … Like I said I examine everything … Including the leadership. I turn over every stone. Especially when I’m looking for the stock’s X-Factor.

For example, and most people don’t know this, but if the CEO is the founder, those kinds of founder-led companies tend to outperform their competition. Crushing their competitors with a CEO from the outside.

Amanda: That makes sense. I’m thinking of two of the companies you mentioned earlier — Steve Jobs with Apple, and Jeff Bezos with Amazon.

I mean nobody cared more about the success of those companies than the guys who started them.

Adam: Right. And then, I want to make sure the company’s CEO has a TON of money in their stock. Take Bezos … when he was CEO, his salary was $81,000 a year. So he only made money if the company was successful.

You think his interests were aligned with investors interests? You bet! So, the CEO — founder or not, MUST have skin in the game. Just like the CEOs of the 5 stocks, I outline in my report, The Exponential Profits Portfolio.

Amanda: That makes sense. CEO’s who are highly invested in their own companies will think about success long-term.

Adam: So look, at the end of the day, we have over 100 data points I review when it comes to making sure we are investing in the right company.

Amanda: So you designed your new strategy behind 10X Stocks with the goal to spot the best stocks in the top megatrends, before they go up.

Adam: That’s correct.

Amanda: Okay, again, and I know this is just a bird’s eye view … but just to summarize, the three key steps in your 10X Stocks strategy are…

- Identify the megatrends.

- Find the right stock.

- Buy that stock at the right time.

Adam: That’s it in a nutshell. And once I identify the number one stock, I’ll put all the information you need in a monthly fast-action report. Just like the one I’m offering you today.

I’ll clearly outline the opportunity and explain what action to take.

I’ll give you the stock name and ticker symbol … detail why I chose them … and give you exact buy recommendations, telling you what price I recommend.

Amanda: So you’ll give us the guidance we need and tell us what action to take.

Adam: I’ll be right there with you every step of the way…

Amanda: Ok, so, to be clear … a membership in 10X Stocks includes The Exponential Profits Portfolio: 5 Stocks Set to Surge 500% This Year…

And at least one new 10X Stocks pick every month for the next year.

Adam: Right, but it doesn’t stop there. Any time we need to make a trade, which might happen one or two times a month, I’ll send you an instant trade alert … you can get it by email. Or you can even choose to be notified via text when there’s a new alert in your inbox.

You’ll also get my Weekly Updates. No matter what happens that week, I’ll send you an update on the markets and our positions.

And of course, you’ll also get access to our private members portal where you can review our model portfolio any time you want.

Amanda: And speaking of your model portfolio, your 10X Stocks service is beating the historical S&P by an incredible, 139% so far this year.

And that doesn’t even include the extraordinary gains you found in your research using THIS brand-new $5 stocks strategy. So Adam, you’re not holding anything back, are you?

Adam: I’m not. Look, I mean it when I say that I want to help our viewers succeed and prosper. I want you to have a shot at profits faster than you might have thought possible. And to give you the chance to go after incredible “once in a decade” type gains like you’ve seen today.

Amanda: You’ve shown us incredible gains of 5X, 10X, even 20X and 30X not seen since the turbulent markets of 2009 and 2002.

Adam: That’s why NOW is the time to act.

Amanda: Okay, I know you’ve spent several years and millions of dollars developing 10X Stocks. And I know this service can retail for $10,000.

Adam: The price is $10,000. However, those who are watching this event now are doing so through a special invitation. I want to make sure everyone has a chance to use this new service. So, today, I’ve drastically reduced the price.

And while 10X Stocks will cost $10,000 a year in the future, I’m not charging anywhere near that today. Not even half that price.

Amanda: Not even half? That’s pretty generous of you.

Adam: Like I said, 10X Stocks is the key to profiting in our turbulent market. And I built it for our viewers. So, for a limited time, I’m sponsoring an 85% discount, making the price to join 10X Stocks today…

Just $1,495.

Amanda: Wow that is an 85% discount from what you could easily charge.

Adam, are you sure?

Adam: I am. But our viewers must act fast if they want to take advantage of this discount. Because I don’t know how long I’ll be able to keep the price this low.

Amanda: Adam, nothing like this has been done before at our company.

You’ve seen the new opportunity here Adam has uncovered with stocks trading below $5 and the brand-new system he’s developed to take advantage of these stocks while they are still under Wall Street’s radar.

And you’ve seen, how the very best of these stocks have gone on to SURGE up to 5X, and 10X in the first 12 months. And even up to 20X and 30X or more over just a couple of years.

Now, this is your shot to reap the market’s most extraordinary gains … with Adam’s new 10X Stocks.

Creating the opportunity to go after a dozen triple-digit-winners for you over the next 12 months.

You DO NOT want to miss this.

Just click the button below to get started today.

When you do, you’ll instantly lock in your chance to get details on a new triple-digit opportunity, every month over the next year.

Plus, you’ll get access to even more 10X Stocks member benefits, including:

Adam’s newest report: The Exponential Profits Portfolio: 5 Stocks Set to Surge 500% This Year.

You’ll also get access to the private members portal where you can review the model portfolio at any time.

You’ll also receive real-time trade alerts. Whenever it’s time to make a trade, Adam will send you an email… and you can even sign up to receive text notifications when it’s time to check your inbox.

You will also have access to an award winning customer service team for any questions you may have about the service.

Adam, did I miss anything?

Adam: No, I think you nailed it. But the new membership order page goes through everything they get in full detail. I think the only thing I’d add is this…

Right now, we are at a unique point in history. A once in a decade opportunity for you to take advantage of all these high-quality stocks that are under Wall Street’s radar. These $5 stocks that could create an EXTREME fortune over the next year. And I want to give you the shot to go after these same types of 500% gains for yourself.

Because what happens over the next 12 months could give you the opportunity to earn the FREEDOM to BELONG to a special class of, respected, independent investors, ready to make a FORTUNE … and live life on their OWN terms.

This is YOUR invitation to join me … I hope you seize the day.

Amanda: This is a phenomenal opportunity here you do NOT want to miss.

Well, thank you for your time, Adam. I’m going to sign up.

Adam: Thank you Amanda. I’m glad you are.

Amanda: And if you want to join me, you’ll want to do so NOW.

An opportunity like this doesn’t happen often.

This is YOUR chance to get a leg up on Wall Street, and go after overlooked stocks with MASSIVE profit potential.

I hope you choose wisely.

Simply click the order button below to get started. I’m Amanda Moore and thanks for watching.